Funds under management:

Patribond, Patrifund, Patrival

Why is important to invest?

Time is one of the main allies an investor can find. Starting to invest as early as possible creates huge long-term benefits.

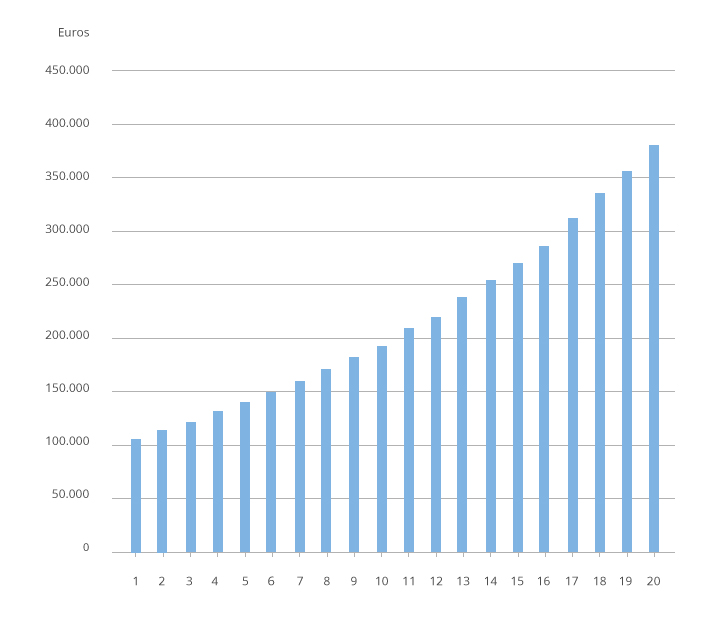

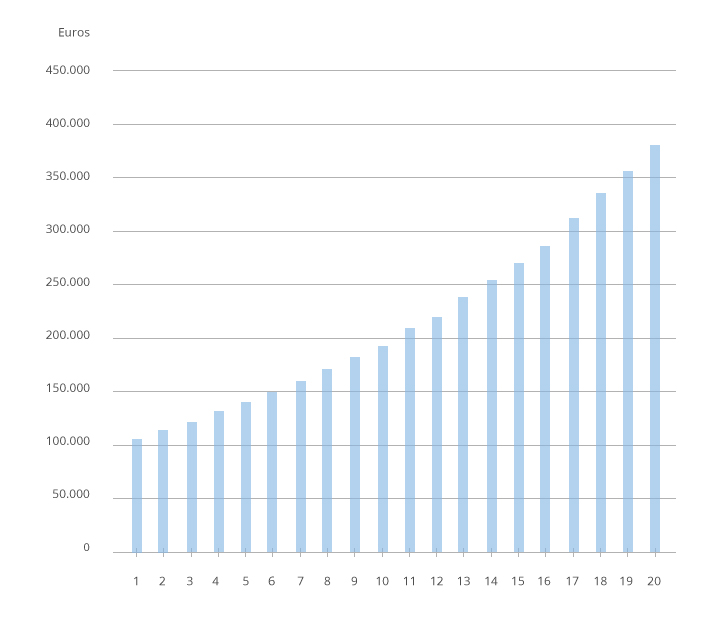

To understand the importance of time when it comes to investing, we must define the concept of compound interest. When we invest in the long-term, we reinvest profits each year to generate higher profits in the coming year. For example, if we start with 100,000 euros and obtain a 5% return in the first year, the second year we will have a capital of 105,000 euros to invest.

The difference might not too big for a one-year period, however, the long-term impact of compound interest can be decisive.

Savings boosted with a good investment criteria that generates acceptable annual returns, year after year increase equity sigificantly over the years thanks to compound interest.

Example: 100.000€ investment capitalized at a 6% annual yield

What is the tax treatment of investment funds?

First , it is important to know that the shareholder of a fund is not taxed until the redemption of the shares occurs. Once the fund is reimbursed, the taxpayer must pay tax on any capital gains obtained. This deferral to pay taxes creates over time an advantage to the investor by increasing compound interest (income reinvested without tax).

The amount of gain or loss is obtained as follows: Redemption value - subscription value. If you have subscribed shares in the same fund at different times, the oldest shares still available are considered sold first, applying the FIFO (First In First Out). This tax treatment provides the ability to actively manage the taxation of investment funds.

TSale or redemption of investment funds.

Investment funds are exempt from taxation until the time of reimbursement. At the time of reimbursement, it applies IRPF on the capital gains obtained in accordance with current tax regulations.

Positive or negative yields in the redemption of units are considered capital gains or losses.

Tax Deferred Fund Transfers

For a transfer to take place, the holder of the shares cannot be a company nor legal person, nor a physically non-resident individual.

The sale of shares will not be taxed when the amount obtained from them is transferred to another investment fund. Also, new units retain the value and date of purchase of which have been sold.

What is the minimum to invest?

There is no minimum

What is the NAV (Net Asset Value)?

The price of the shares, both for the purposes of subscription and redemption, is called the net asset value. In most of the funds it is calculated daily: the daily value of equity divided by the number of shares in circulation, and thus a net asset value of each is obtained.

Basically, when a person invests money in a mutual fund you are buying a part of a portfolio that is invested in a number of assets. Each of these parts is called participation. Every time an investor puts money into the fund, is entitled to an aliquot part of the assets in which the fund is invested.

When someone decides to withdraw their investment, the Management gives the appropriate exchange the investor is entitled for his shares. The number of units of a fund changes continuously as it increases and decreases every time someone adds or removes money